Trading bots have become an integral part of the trading landscape, offering automated solutions that can potentially enhance profitability and efficiency. Yet, despite their benefits, the question remains: Do trading bots fail? In this comprehensive guide, we will explore the functionalities of trading bots, their benefits, the risks they carry, and the conditions under which they may fail.

What Are Trading Bots?

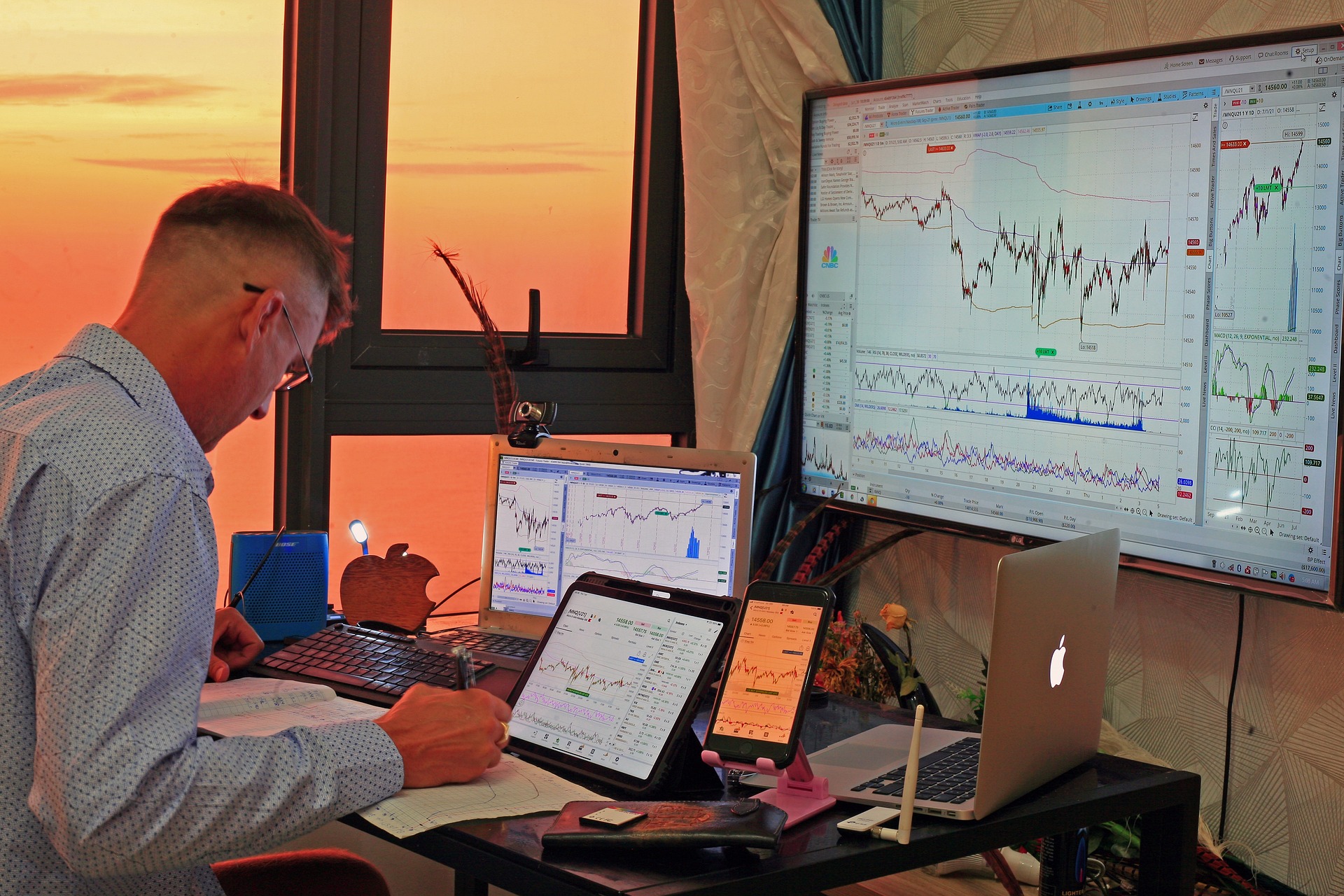

Trading bots are automated software programs designed to engage in trading on various financial markets using a set of predefined rules and algorithms. These bots are used primarily to increase the efficiency and effectiveness of trading strategies, taking advantage of the speed and data-processing capabilities that computers have over human traders. By automating the trading process, these bots can execute trades at optimal times based on their programming, which may consider factors such as market volume, orders, prices, and time, often reacting faster than humans can.

Types of Trading Bots

Trading bots come in a variety of types, each tailored to different trading strategies and market conditions. Some bots are designed for high-frequency trading, which involves making numerous trades per second to capitalize on very small price fluctuations. These bots require a highly robust technological infrastructure to perform effectively.

On the other hand, there are bots programmed for longer-term strategies, focusing on trends and patterns that unfold over weeks or months. These bots are usually less demanding in terms of execution speed but require sophisticated predictive algorithms to adapt to changing market conditions over longer periods.

How Do Trading Bots Work?

Trading bots function by following a complex set of algorithms and trading signals to make decisions. Initially, they analyze vast amounts of market data—prices, volumes, time, and historical indicators, among others—to identify potentially profitable trading opportunities. This analysis involves both simple and advanced mathematical models and may incorporate machine learning techniques to improve prediction accuracy.

Once a potential trade is identified, the bot executes buy or sell orders on behalf of the trader. The main advantage here is speed and timing—trading bots can detect changes in market conditions or new information far quicker than human traders, enabling them to execute trades more swiftly and efficiently, often capturing opportunities that would be missed by humans due to physical and mental limitations.

Advantages of Using Trading Bots

Trading bots provide several significant advantages that can enhance trading effectiveness and efficiency. These advantages include the capability to operate continuously, rapid responsiveness to market fluctuations, and the ability to make decisions devoid of emotional bias, which are critical in trading environments.

| Advantage | Description | Impact on Trading |

| 24/7 Operation | Trading bots can operate around the clock, handling trades even when the market is active during non-business hours or when the trader is asleep. This constant operation ensures no profitable trade opportunities are missed due to human unavailability. | Maximizes trading opportunities and potential profitability. |

| Quick Response to Market Changes | Bots can process market data and execute trades much faster than humans. This rapid analysis and action can be crucial during volatile market periods when prices change swiftly. | Enhances the ability to capitalize on small windows of trading opportunity that may quickly disappear. |

| Elimination of Emotional Trading | Bots operate based on algorithms and predefined strategies without fear, greed, or other emotional influences that often negatively affect human traders. | Reduces the risk of irrational decisions based on emotion; increases the consistency of trading decisions. |

The Downsides of Trading Bots

Despite their benefits, trading bots are not without drawbacks. Technical failures and market limitations are among the chief concerns that can lead to potential losses.

Technical Failures

Technical issues are a common pitfall for trading bots, affecting their reliability and effectiveness. These failures can vary widely, from minor software bugs that are quickly resolved to severe connectivity issues that might result in missed trades or worse, financial loss.

| Type of Failure | Cause | Consequence |

| Software Bugs | Errors in the code or algorithm can cause unexpected behaviors or incorrect trading actions. | Can result in unintended trades or the failure to execute trades, potentially leading to significant losses. |

| Connectivity Issues | Problems with the internet connection or issues in communication with trade exchanges. | May cause delays or the inability to execute trades, especially detrimental during high-volatility periods. |

Market Limitations

Trading bots, while sophisticated, still rely heavily on historical data and market patterns, which can be unreliable during unanticipated or extreme market conditions.

| Limitation | Description | Impact |

| Reliance on Historical Data | Bots use past market data to predict future movements. This method may not be effective during unprecedented events or atypical market behaviors, often referred to as “black swan” events. | May lead to inaccurate predictions and poor trading decisions in the face of novel market conditions. |

| Inflexibility in Unpredictable Markets | Bots may not adjust quickly to sudden market changes or news events that haven’t been previously encountered. | Results in potential losses if the bot cannot adapt or pause operations amid rapidly changing conditions. |

Human Factors in Bot Failures

While trading bots can significantly automate and streamline the trading process, human factors can still contribute to their failure. Misconfiguration and overreliance are two critical issues where human intervention can directly impact the performance and effectiveness of trading bots.

Misconfiguration

Misconfiguration of trading bots is a prevalent issue that can lead to their failure. When setting up a trading bot, traders must specify certain parameters that dictate how the bot will operate. If these parameters are set incorrectly, the bot might not perform as intended, which can lead to unwanted trades and potential financial losses. Here are some common ways misconfiguration can happen:

- Incorrect Strategy Parameters: Setting up trading strategies that are not aligned with market conditions or the trader’s risk tolerance can lead to poor performance and losses.

- Faulty Risk Management Settings: If the risk management settings are too aggressive or too conservative, it may result in either excessive losses or missed opportunities, respectively.

- Lack of Updates: Failing to update the bot’s settings in response to changing market dynamics can render a trading strategy obsolete and ineffective.

Overreliance on Bots

Overreliance on trading bots is another human factor that can lead to failures. Traders might become too dependent on the automated processes and neglect necessary oversight. Here are some typical scenarios where overreliance on bots becomes a problem:

- Ignoring Need for Supervision: Traders might assume the bot can handle all aspects of trading without human intervention, which is rarely the case. Continuous monitoring is crucial to ensure the bot operates correctly and to intervene when unexpected market conditions arise.

- Misplaced Trust in Automation: Traders may believe that the bot is infallible, neglecting the fact that all automated systems have limitations and are susceptible to errors, especially in complex and fast-changing markets.

- Underestimating Market Complexity: Markets are inherently unpredictable and often influenced by factors that cannot be programmed into a bot. Traders who fail to account for this complexity may find that their bots do not perform as expected.

By understanding these human factors and actively engaging in the management and supervision of trading bots, traders can enhance their effectiveness and mitigate potential failures. It is essential to balance the use of technology with informed human judgement to achieve the best trading outcomes.